Real Estate Challenges for the New Lebanese Government - July 2018

- Thursday, October 17, 2019

amoxicillin uk

buy antibiotics online

redirect amoxicillin online

tamoxifen

tamoxifen shortage uk

go tamoxifen moa

abortion pill

usa

buy abortion pill

Amitriptyline for Anxiety

amitriptyline

50mg

Amongst major challenges to the new Lebanese government is the stability of the real estate and housing sector, is it possible to avoid a price crash and survive amid the current market fundamentals?

Property developers and contractors are facing their own challenges as well, where the margin of adaptation with the market fluctuation is narrowing and the competition is getting tougher due to the scarcity of financing and the reduction in consumer purchase power.

The Media coverage for the latest collapse of major developers is intolerable; it is not reflecting the actual status of the real estate sector rather than the mismanagement and unethical performance by some companies.

-

Market fundamentals

-

Banking Role

The stability of the market depends on main growth sectors include banking, real estate, hospitality and the business environment. It is clear that when the economy suffers, the real estate sector will be directly affected, but hopefully not with the same ratio. The Central Bank and the Banking sector are the major persuasive players; they are in an unavoidable situation where new innovative strategies have to be proclaimed to upkeep the market in a stable condition including lowering interest rates, new financing facility tools and the partial unlock of the $113Billion of bank deposits including Legal Reserve Requirements. Looking at the $21.0Billion total housing ($13.0B) and construction loans ($8.0B) from local banks, representing less than 30% of total bank loans to the private sector, is not a critical number at all.

-

Interest Rates

Higher interest rates are basically due to the higher trade deficit which used to be shielded by allocation of expats, foreign direct investments especially from GCC citizens and tourism. Expats are still able to transfer especially from troubled regions worldwide, but the foreign direct investment and tourism are contributing lesser to cover the trade deficit. Although this rise in interest rate will attract foreign wealth into Lebanon as 9-10% interest rate is much too attractive for a country that has an impeccable track record in currency stability. However, such high interest rates will force domestic and international investors to drift from real estate into treasury bonds for 3-5 years. Therefore, real estate investments should consider a return on a yearly basis at least 10-15% so that investors might consider reinvesting in real estate instead of bank bonds and notes given that the risk profile is similar between both but real estate is slightly riskier. The rise in interest rate will also explain the increase in the bank deposits for the next 2-3 years at least.

-

CDS : Credit Default Swaps

A CDS is a contract in which the seller agrees to pay the buyer all the security premium along with interest in the event that the debt issuer defaults or experience another credit event. Generally, a higher CDS represents a higher risk that a country could default.

Clearly, the CDS price has increased in 2018 to reach 711.4 bps compared to 390 bps in 2017 which represent an increase of 82%. This is a clear indication of the weakening of the economy. The price however is still low to consider the country’s default as it require a much higher spike so that Lebanon would be considered to be in a dangerous territory. As for those who are skeptic on Lebanon and signal a price crash coming soon, they are advised to enter into the CDS contract instead or target a successful real estate projects with proper IRR along with professional market leaders.

-

Order Of Engineers Data

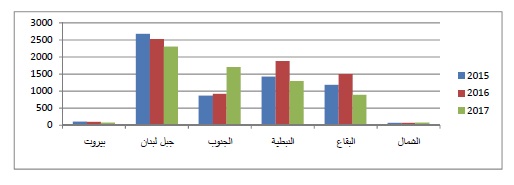

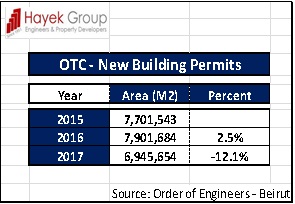

Order to Commence is measure by the Order Of Engineers and Architects in Beirut, is a direct indicator on the current construction activity in Lebanon since landlords can hold on building permits without actually starting the construction process. For instance, if we compare the OTCs in regions, we notice the following:

OTC Data

Beirut has comparatively a small area compared to the rest of the Lebanese Cazas so it would be expected to have less total OTCs compared to the rest. However, what is clear is that the OTC in Mount Lebanon decreased by 12.1 % in 2017 relative to 2016, which is an acceptable rate relative to the increasing state economic problems.

Beirut has comparatively a small area compared to the rest of the Lebanese Cazas so it would be expected to have less total OTCs compared to the rest. However, what is clear is that the OTC in Mount Lebanon decreased by 12.1 % in 2017 relative to 2016, which is an acceptable rate relative to the increasing state economic problems.

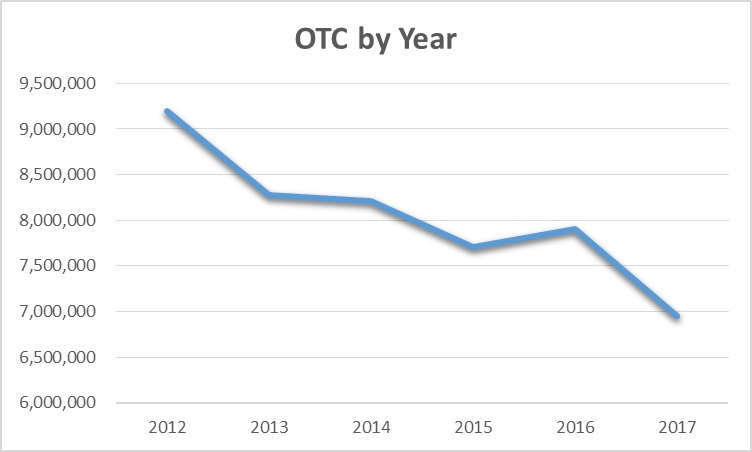

Looking back from a high level perspective, the OTC total area in Lebanon is also subject to a reasonable drop of 25% since 2012 which is also a mild drop within our expectations.

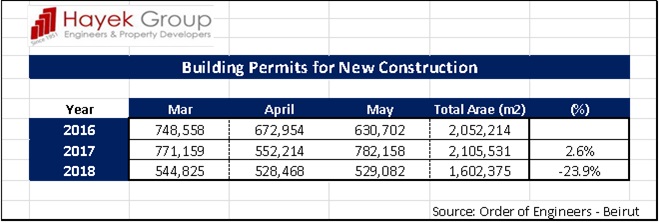

The total area of registered new building permits recorded a 2.6% increase in March, April and May of 2017 relative to same period in 2016, and reduced by 23.9% in the same period in 2018 which is also a reasonable figure within market expectations.

-

Civil Status Data .

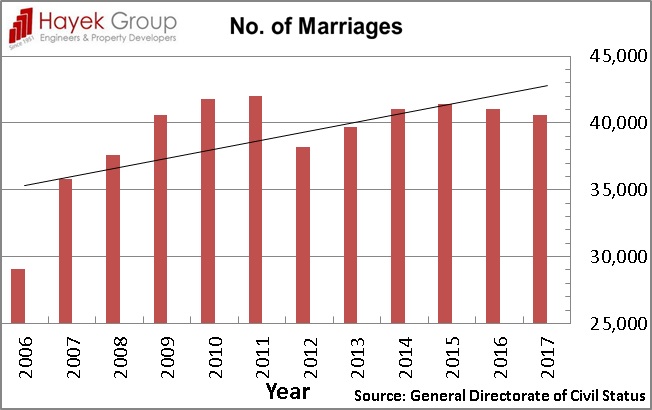

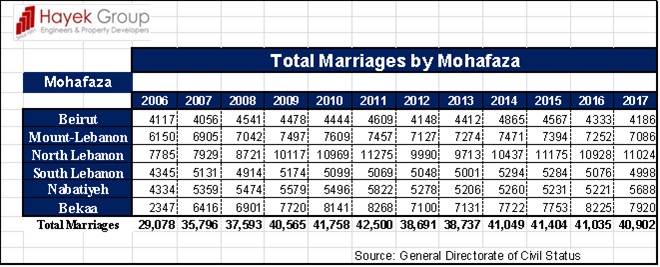

In theory, most of newlyweds would require to buy a residential house in Lebanon so analyzing the quantity of newlyweds would determine to some extent the minimum housing consumption needed.

In theory, most of newlyweds would require to buy a residential house in Lebanon so analyzing the quantity of newlyweds would determine to some extent the minimum housing consumption needed.

By looking at the table by Directorate General of Civil Status, if we eliminate the outliers, we can say that an average of 40,000 residential units per year on average from 2006 to 2017 of registered marriages, equivalent average value of $750M, which is the amount of subsidized housing loans by the Central Bank, using the 15% & 25% legal reserve requirements for deposits in USD and LL respectively; the central bank current priority is subsidizing loans to the state debt and let the government deal with the housing crisis.

-

Political Stability

One of the hardest data measurements are the qualitative aspects of the government. The new government has to provide an attractive incentives for foreign investment; even though, the investment environment suffers from complicated rules and regulations, corruption, arbitrary licensing decisions, complex customs procedures, high taxes, tariffs, fees, archaic legislation, and weak economic growth. The new government should build on the positive aspect of the political stability and the expected new reforms under the leadership of president Aoun, the head of the council of ministers Mr. Hariri, the speaker of the parliament Mr. Berri and all major political parties. The new parliamentary election was successfully completed and the new coalition cabinet is expected to reflect all the political parties.

The current security measures are well controlled by qualified leadership and professional officers, the freedom of speech and democracy are preserved and well protected in a troubled region where freedom of speech is forbidden and this is considered a major attraction to investment. So to some extent, it is safe to say that Lebanon’s political environment is attractive for foreign investments.

-

Market Temptations

.jpg) The market enjoys some positive indications including affordable and attractive construction cost since general contractors are accepting minimum profit due to competition, and the availability of the Syrian workforce. The new rental law is currently applicable, if buyers converted to rent, the current stock of vacant apartment will slowly diminish. Another consideration should be well-thought-out by owners which is leasing and renting with an option to buy.

The market enjoys some positive indications including affordable and attractive construction cost since general contractors are accepting minimum profit due to competition, and the availability of the Syrian workforce. The new rental law is currently applicable, if buyers converted to rent, the current stock of vacant apartment will slowly diminish. Another consideration should be well-thought-out by owners which is leasing and renting with an option to buy.

Investor’s attraction for rented buildings is getting more considerations; also private banks have a good appetite to mortgage rented properties with payment facilities rather than traditional housing loans with high interest rates.

-

Challenges

The spillover from the Syrian conflict, including the influx of more than 1.2 million registered Syrian refugees, has increased internal tension and reduced economic growth to the 1-2% range in 2011-17, after four years of averaging 8% growth.

Weak economic growth lower tax revenues, while the largest government expenditures remain in debt servicing, salaries for government employees, and transfers to the electricity sector. These limitations constrain other government spending, limiting its ability to invest in essential infrastructure improvements without the involvement of international donors. The role of the new government is to issue the proper legislations to speed up the process without any unnecessary bureaucratic delays.

The government should secure a soft landing for real estate prices, by providing innovative legislations for new financing tools to be implemented by the private sector to inject funds into ongoing projects at convenient terms, and attract foreign investment by building trust and provide incentives for overseas investors and Lebanese diaspora, the market is chock-full of buying opportunities which was never available before.

New regulations by Central Bank are urgently needed to provide new licenses to attract private investors into distressed property market, including the formation of private funds to invest in distressed properties (BDL Circular 427 – 2017). The central bank also should instruct local banks to ease on grade 6 loans to avoid bankruptcy for the building industry and should encourage new banking instruments for investors.

The parliament should process all pending laws related to the building and housing sector especially the Insolvency law for real estate developers, city planning regulations and taxation.

The ministry of finance should present the state financial budget on a monthly basis. It also must adapt transparent statistical reforms and support the Central Administration of Statistics to provide periodical indices for economists and researchers and other government bodies.

Conclusion:

The main challenge for the new government is the corruption, and structural reforms of the public sector; this will lead to a gradual correction of the trade deficit and lower public debt and commercial interest rates and increase consumer’s purchasing power which will affect all sectors including the real estate which is trembling due to the general economy of the state, even though the current market statistics is indicating a surplus of available apartments with a total value exceeding $3.8B, but changes must be made in the housing culture by adapting smaller units similar to most EU countries and developers should reconsider nominal profit margins and finally the migration of inexperienced and inflated developers out of the market.

The main concern is: can the current political system handle the critical economic problems? Since those same parties who participated in ruling the country for the past 25 years were re-elected and asked to rule it again? Fortunately they all have to work seriously otherwise they all will be in trouble.

Despite the regional dramatic conflicts, the international umbrella protecting this country from any serious security measures is likely to continue in the future, since no one will benefit from any military conflict in the foreseen future, which will cause the migration of refugees into troubled EU countries.

Financial rating agencies are considering many risks for the Lebanese economy, but still have a non-crash status. On the contrary IMF is expecting a growth of 1.5 -3.0 % in the near term.

Out of the average 39,000 registered marriages per year at least 50% have to consider renting their homes instead of purchasing, where property owners are willing to rent at 5-10% rates of the value of the apartment, another 50% will consume most of the vacant apartment stock within 5-7 years.

For the past 3 years, real estate prices were subject to a correction in an acceptable pace within a margin of 30% to 35% which is normal under such sever state debt and corrupt economical structure. It is not anticipated to have a price crash as in regional and international countries due to the crisis in 2008; a strong rebound is unlikely soon, yet even the real estate market in Lebanon is trembling but it will reshape in the near future without any fears from any crash due to the many attractive elements which kept this sector safe in the past. Developers who know what, where, when and how to build and respect the new construction business intelligence and market fluctuations, can still do a great job.

.jpg)

A good example is Achrafieh region in Beirut, where the No. of total sales in 2017 of 740 is on the uptrend since 2015 and almost close to the rates in 2007 & 2009 as per the General Directorate of Land Registry and Cadaster.

Government spending in infrastructure is not an option any longer, instead it is a necessity, an amount of $2B per year is the minimum required to tackle the market liquidity and increase influx of foreign currency at international low rates (3%-5%)

The new government has to act immediately to restructure the state’s public sector to have a transparent balance sheet complying with rules and regulations as set in Cedre conference and to apply reforms using the wise control of the central bank, the potential of the local banks and the capabilities of the private sector, not to mention the expected income from the oil and gas exploration and the power of the expats, all will add up to prevent any price crash in real estate prices at least for the next few years.

Abdallah Hayek PE

Hayek Group LLC

Beirut, July 2018

Back To Newsletters